VOCC Year in Review 2022: Our Top 5

In 2022, we reported 164 news items (on average about 14 news items/month) from the software and cloud market as part of the VOICE service. In addition, 21 focus topics were covered in depth in virtual sessions held on the last Friday of each month. We have summarized the top five topics of the year for you in this blog post.

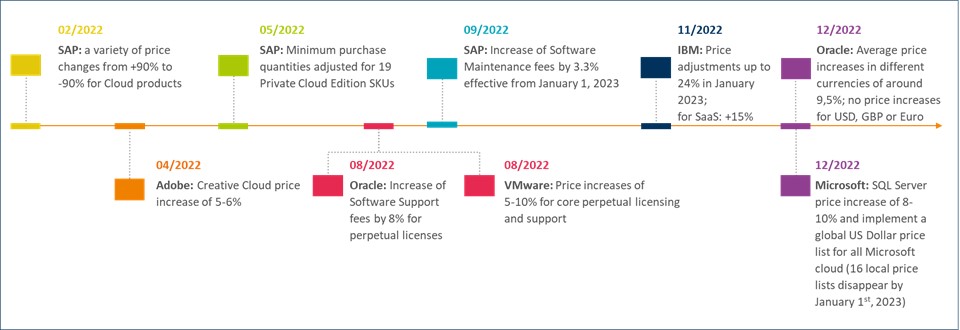

1) Price increases: Adobe, IBM, Microsoft, Oracle and VMware are raising their prices by up to 24%.

Software manufacturers have also taken the macroeconomic price increases as an opportunity to announce price adjustments for software licenses, subscriptions and maintenance, some of which are significant. Starting with SAP and Adobe, which increased the prices for their cloud usage rights, SAP also made a price adjustment for maintenance and VMware for new licenses and support. In the second half of the year, price increases were again exacerbated by the unfavorable euro/dollar exchange rate. IBM revised its original 8% price increase up to 24%, Oracle is increasing maintenance by 8% starting in 2023, and Microsoft is also adjusting prices for SQL Server 2022. Companies should first check in each case whether the announcements apply to their contract and whether the contractually agreed announcement deadlines have been met.

2) Russia: Majority of large software vendors cease business in Russia

As a result of the sanctions against Russia, the major software providers have largely discontinued their business in Russia. This includes the sale of new licenses, the provision of cloud services and, in some cases, the provision of software support services. This presents companies in Russia with some major challenges in maintaining their business. Multinationals headquartered outside Russia whose subsidiaries in Russia are not affected by the sanctions should come to an agreement with software manufacturers - if they have not already done so - on the (remaining) range of services and, if necessary, also adjust the conditions to the reduced scope of services in the contracts.

3) M&A activity: Broadcom buys VMware

In May, Broadcom and VMware agreed on a takeover for a purchase price of around $61 billion. Broadcom plans to sell the software portfolio under the VMware brand in the future. VMware joins prominent company in this regard. With CA Technologies (2018) and Symantec (2019), Broadcom has already taken over larger software providers in the past. As a result of acquisitions, it can be observed time and again that providers change their pricing and licensing models to the disadvantage of users. Furthermore, vendors are increasingly using auditing to gain better visibility into contract inventory and usage and to increase near-term revenue. The acquisition of VMware by Broadcom is still subject to approval by antitrust authorities. However, companies using VMware products should already take a close look at their contract situation and run through possible options.

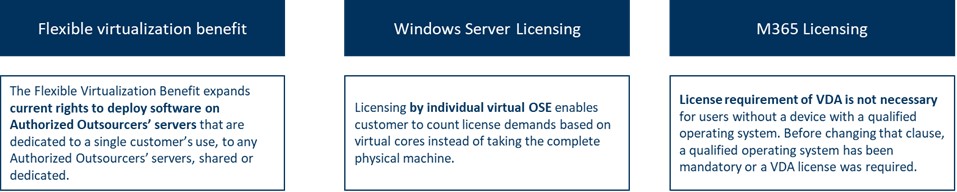

4) Microsoft Product Terms Changes: Microsoft changes license terms for Windows Server and Virtual Desktop access

Over the course of the year, Microsoft was confronted with increasing criticism that the existing license terms hinder the use of Microsoft licenses in third-party cloud environments. In response, Microsoft added the Virtual Flexibilization Benefit to its Product Terms, which now also permits the use of Microsoft licenses in public cloud environments of so-called Authorized Outsourcers (not including Azure, AWS, Google Cloud, Alibaba and Authorized Mobility Partners). In this context, two further adjustments have been made to the Product Terms, which are also relevant for on-premise installations. For Windows Server, licensing by virtual capacity based on cores is now available. For access to virtual desktop environments, users licensed with M365 F3/E3/E5 are no longer required to purchase an additional VDA license or VDA add-ons, even if the device does not have a license for a qualifying operating system. Microsoft customers should consider how they can take advantage of these changes to reduce their licensing costs.

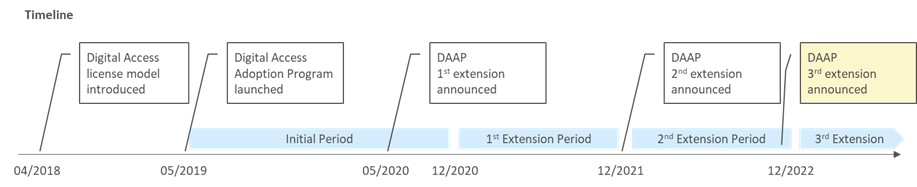

5) Indirect use: SAP extends Digital Access Adoption Program until further notice

In 2018, SAP introduced a new licensing model for indirect use. The document-based licensing model is intended to make indirect use measurable but does not change the fundamental controversy surrounding indirect use. In 2019, SAP had set up a discount program (Digital Access Adoption Program - DAAP for short) to make the switch attractive in terms of price for existing customers. Since then, the DAAP has already been extended twice with a time limit. In November, the third extension followed for an indefinite period. SAP is obviously pursuing a strategy here of using a high initial discount to manifest the recognition of the license obligation for indirect use in the respective customer contracts and to generate additional revenue via the future maintenance or rental payments. All companies that have not yet converted their contracts to S/4HANA will therefore also have to deal with the issue of digital access licensing in 2023.

About the Vendor Observer Competence Center (VOCC):

The Vendor Oberserver Competence Center (VOCC) is VOICE e.V.'s "trusted community" for IT managers, vendor managers, IT buyers and license/contract managers who want to stay up to date on software and cloud services licensing and regularly exchange ideas with like-minded people.

More information & free trial participation:

If you are curious, you can find more information about the service on the VOICE website.

Otherwise, there is always the possibility of a free trial participation. You can find the contact details on the VOICE website or contact us directly. We would be pleased to welcome you as a participant in the VOCC.

Authors: Stephanie Riesebeck & Felix Baran