VMware takeover by Broadcom - developments, impact and outlook

The takeover of VMware by Broadcom at the end of 2023 has changed the IT world forever - with far-reaching consequences for customers, partners and the entire VMware ecosystem. Since then, continuous adjustments to licenses, products and partner structures have caused great uncertainty.

Change of strategy for licenses and contracts: Subscriptions instead of perpetual licenses

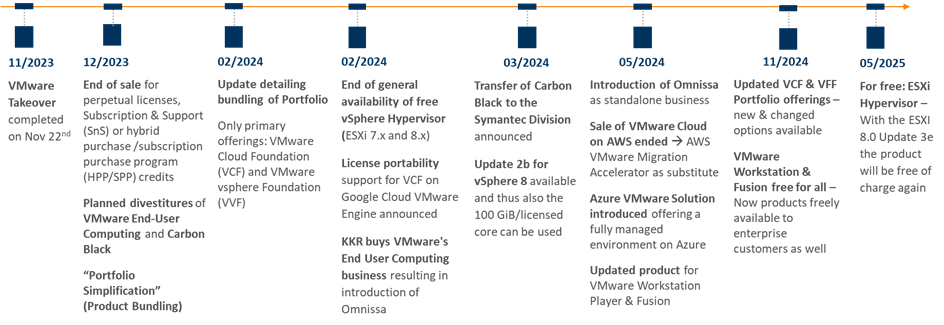

Shortly after the takeover, Broadcom introduced far-reaching changes to the license model. The sale of perpetual licenses was discontinued at the end of 2023 - a switch to subscriptions has been mandatory since then. This forced many companies to change their contract structures and license strategy at short notice with the next contract renewal.

A further upheaval followed in spring 2024: the sale of the end customer division to the investor KKR and the founding of the new company Omnissa caused additional uncertainty - particularly with regard to license transfers and support contracts.

With the release of VMware Cloud Foundation (VCF) 9.0 in June 2025, the next drastic changes were introduced: a new licensing model, new add-on options, consolidated license files and mandatory compliance reports every 180 days put customers in a tight spot. Companies that do not react quickly risk incurring significant additional costs if they fail to comply with the new regulations after the relevant deadlines.

Criticism of business practices and rising costs

The way in which Broadcom is introducing these changes has also been widely criticized. There have been many legal disputes concerning support contracts, contractual penalties for late migration and price increases. Small and medium-sized customers in particular feel left in the lurch, while Broadcom is increasingly focusing on major customers and long-term loyalty.

VMware portfolio in transition

The product portfolio has also been massively restructured. From December 2023, many individual VMware products were bundled into the primary products VMware Cloud Foundation (VCF) or vSphere Foundation. At the same time, classic individual products such as the free vSphere Hypervisor were discontinued. Bundling led to significantly higher costs for some customers, as they were no longer able to license only the products they actually needed. Added to this were the contractual implications of the spin-off of Omnissa to KKR.

However, pressure from customers led to some improvements over time: In November 2024, not only was it announced that Workstation and Fusion could also be used free of charge for Enterprise customers, but vSphere Enterprise Plus was also added as a new option to the portfolio. Broadcom thus accommodated its customers a little and offered them a little more choice. Since June 2025, ESXi Hypervisor has also been available free of charge again with the 8.0 3e update.

In addition, the long-announced VCF 9.0 with new AI integrations has also been available since this month. Broadcom already announced in 2024 that it wanted to establish VCF as an alternative to the public cloud and is thus pursuing the strategy of a private cloud with private AI. It therefore remains exciting to see what further portfolio developments can be expected in the future.

Partner landscape in upheaval

Not only customers, but also partners have been hit hard by the restructuring. A new partner program has been active since May 2024 - with new partner levels, certifications and requirements.

Pinnacle partners benefit from extended distribution rights, while smaller partners struggle with stricter conditions. Some are turning away completely or only offering limited support.

Another sign of consolidation: In June 2025, it was announced that the lowest partner level ("Registered Partners") in North and South America and Asia-Pacific will be abolished. At the same time, providers such as AT&T, Beeks Group, Anexia and Ingram Micro are actively positioning themselves with alternatives to VMware - including migration services to other cloud environments.

Switching to alternatives? With caution!

Companies considering a switch from VMware should act strategically and with foresight. The switch is associated with high costs, risks and organizational effort. Vendor lock-in remains a key issue - both for VMware and for possible alternatives.

However, the advantages and disadvantages of a switch can differ for the respective company depending on the strategy. As there is not yet much experience of such a change, it is still unclear whether a change is generally worthwhile.

Gartner published several studies and webinars on this topic in 2025. Key message: A migration must be prepared thoroughly over the long term and carefully planned in line with contract terms. According to Gartner, a contingency plan is now mandatory - even for companies that are staying with VMware for the time being.

Therefore, do not remain inactive, but evaluate the possible options for action for companies at an early stage so that you are not surprised by further changes and cost increases without an alternative plan. We will be happy to answer any further questions you may have on this topic.