Software Asset Management – Price Increases in 2025 and Trends for 2026

As part of the Vendor Observer Competence Center (VOCC), we review the latest developments and changes in the software and cloud market on a monthly basis. At the turn of the year, we summarize the key developments in 2025 and look ahead to 2026.

Price increases in 2025

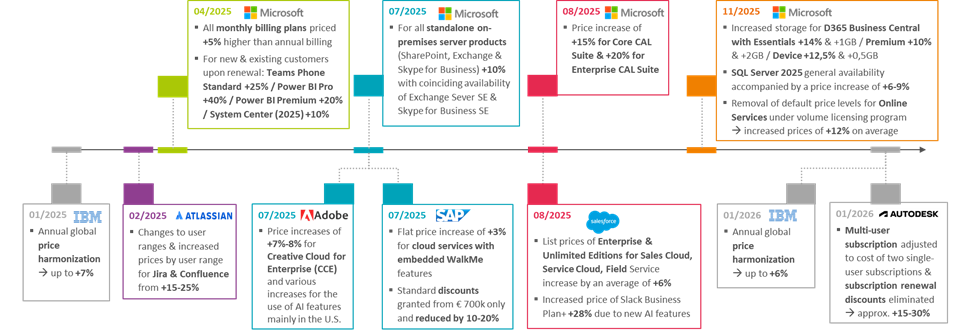

Looking back on 2025, customers had to accept a number of price increases from major software vendors.

Microsoft in particular had some unpleasant surprises in store for customers. In addition to general increases for some products, especially on-premises server licenses, the elimination of discount scales for online services in November of last year caused unrest among customers. However, prices will rise significantly at the next contract renewal, and not only because of the elimination of discount scales. Microsoft has already announced the next price increase for July 2026:

The range of features will be adjusted for Office 365 and Microsoft 365 subscriptions – combined with a price increase of 5%–33% of the list prices. Some additional features that were previously available separately as a suite will be integrated into the range of features of the regular subscriptions in the future. This means that from next July, customers will no longer have a choice regarding these features and will have to accept the higher prices. Significant price increases of 25% and 33% are particularly noticeable for the M365 F1 & F3 subscriptions.

However, other vendors such as IBM, Atlassian, Adobe, SAP, and Salesforce also implemented price increases in 2025, with IBM and Autodesk already announcing increases for January 2026. This continues the trend in cloud services of having to factor in price increases with every contract renewal.

Strategic partnerships for the further development of AI

2025 was also marked by a large number of initiatives to further develop AI functionalities. To this end, major software vendors have joined forces to further develop AI technology in a targeted manner within the framework of strategic partnerships. Companies that are usually competitors are working together as partners to jointly expand their AI infrastructure, such as Meta & Google. Many large IT companies announced partnerships in the AI field last year – including major software vendors such as Adobe, Broadcom, IBM, Microsoft, Oracle, and SAP, as well as AI specialists and tech giants such as Google, Meta, Nvidia, and Open AI. Gartner has already predicted in a press release that IT spending will increase further to over one trillion US dollars, driven largely by the expansion of AI technology and related infrastructure.

Large vendors are expanding their AI expertise through acquisitions of smaller companies.

In addition to partnerships, large software companies are also acquiring AI specialists to expand their AI expertise and drive innovation in a targeted manner. IBM and Salesforce stand out in particular, both of which made major investments in 2025 to acquire several AI specialists at once. IBM, for example, bought Confluent for around $11 billion, and Salesforce paid around $8 billion for Informatica. Both companies are thus continuing their strategy of strategically advancing AI development through acquisitions. However, these investments must also be refinanced and are already being passed on to customers in some cases, for example by integrating AI functions into existing products with corresponding price increases – without the option of deselecting these functions.

Outlook for 2026

The race for supremacy in AI technology will continue in 2026. According to Flexera's IT Priority Report, AI integration is at the top of the priority list for 33% of IT decision-makers. At the same time, however, both the demonstrable profitability of AI investments and the tracking of these investments, including cost development, represent a major challenge.

In addition, despite rising AI investments and general IT costs, more and more cost-saving initiatives are being pursued. The lack of transparency regarding IT costs, especially shadow IT and the development of cloud and SaaS costs, is a focus of attention, as many decision-makers are convinced that their IT expenditures are significantly too high.

This tension is exacerbated by constantly increasing or changing regulations that attempt to keep pace with innovations. IT departments must continuously track changes in legislation and establish governance measures to ensure compliance with regulations such as DORA, NIS-2, or the EU AI Act. At the same time, developments in the area of digital sovereignty are constantly changing and not yet mature.

In summary, it can be said that in 2026, companies will face the major challenge of reconciling AI initiatives and measures for digital sovereignty with existing and new regulations, as well as with demanding cost-cutting measures. As a prerequisite, it is advisable to establish transparency regarding your own cloud, AI, and software usage in order to gain the best possible overview of cloud and software expenditures and their cost development. Based on existing usage and actual costs, compliance and cost initiatives can be addressed.

The VOCC supports companies in this process by providing up-to-date and relevant market information. If you are interested in participating in the VOCC, please contact us directly and benefit from the information presented, recommendations for action, and the exchange of experiences within the VOCC community. We would like to invite you to the next meeting and look forward to welcoming you as part of our monthly "Trusted Community."